At the start of every fiscal year, it’s crucial to declare your tax-saving investments using Form 12BB. This simple step ensures accurate tax deductions from your monthly salary, potentially increasing your take-home pay. No need to stress about exact amounts – just estimate your planned investments at the beginning of the year. You only submit actual proofs at the year-end, and the best part? You can invest more or less than initially declared. Flexibility is key, so don’t worry if your eventual investments differ from your initial declaration. Form 12BB simplifies the process for a smoother financial journey.

Table of Contents

What is Form 12BB?

Form 12BB is like your ticket to tax benefits! Starting June 1, 2016, if you’re a salaried employee looking to claim tax deductions, this form is your go-to. It’s a simple statement of your claims for tax benefits or rebates on your investments and expenses. Just hand it over to your employer at the end of the financial year, and you’re good to go. Using Form 12BB, you declare the investments you made during the year. You only need to provide evidence at the year-end. This form applies to all salaried folks, making the process a breeze.

What is the purpose of Form 12BB

Form 12BB lists the claims you have made for various tax benefits. If you are a salaried employee, you must submit the form to your employer in accordance with income tax requirements in order to get the tax refund. At the end of the fiscal year, the form 12BB is to be submitted.

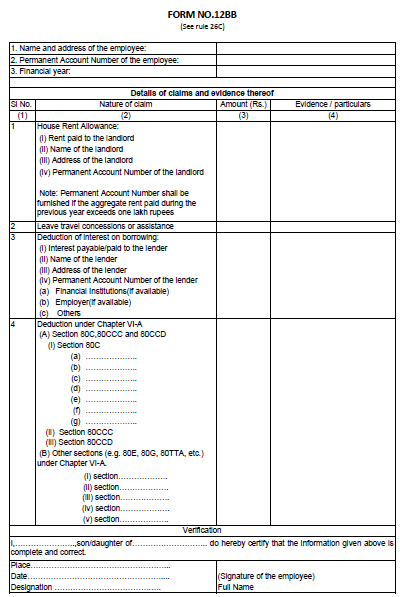

Form 12BB Sample

How To Generate Form 12BB

You can download the form 12BB from income tax website here.

What deductions can you claim via Form 12BB

These are the deductions/exemptions that you can claim through Form 12BB.

- House rent allowance (HRA)

- Leave travel concession or Leave travel allowance (LTA)

- Interest on home loan

- Deduction under Chapter VI-A

How to Fill Form 12BB?

Form 12BB filling isn’t as difficult as it seems. You will be guided step-by-step through every part of this guide, with explanations on what details to include and how to maximize your tax benefits.

Part I: Personal Details

- Full Name

- Address

- Permanent Account Number (PAN)

- Financial Year (2023-24 for Current year)

Part II: Details of claims and evidence

1. House rent allowance

- Amount of house rent paid

- Monthly rent receipts or rental agreement

- Name of your landlord

- Address of your landlord

- PAN of your landlord if the total house rent paid during the year is more than Rs.1 lakh.

- If you don’t have not HRA in your CTC and you live in rental housing, in such case you can claim similar tax deduction under section 80GG.

- If your monthly house rent is more than Rs. 3,000, then only you need a rent receipt.

- If you live in your own house, you are not eligible for the HRA exemption.

- If your parents receive rent from you, it’s best for them to include that rental income in their income when submitting their income tax return.

- Stay away from submitting fake rent receipts as this could get you in problems with the tax authorities.

- A formal rent agreement should be printed on stamp paper.

2. Leave travel concessions or leave travel allowance (LTA)

- Eligibility: You can only use LTA if it is included in your CTC.

- Who can benefit: You, your spouse, your kids, your parents, and your dependant siblings.

- Frequency: You are eligible to submit two LTA claims in a block of four years (2022–2025 – Current block).

- Carry-Forward Option: If you only used one LTA in the previous block, you can utilize it in the first calendar year of the next block.

- Domestic Travel Only: Only domestic travel is covered by LTA; foreign travel is not. No exemption for hotel expenses.

3. Home loan interest

- Your lender’s interest certificate which details the type of loan and the interest you paid.

- Certificate of Possession/Completion for newly constructed or renovated properties.

- Self-Declaration which details whether the property is rented out or used for personal use.

- Interest Payment: Deduct interest paid on loans for building, buying, renovating, or repairing property (up to Rs. 2 lakh for self-occupied property, full amount for rental property).

- Principal Repayment: You can deduct up to Rs. 1.5 lakh under Section 80C, which is applicable to both rental and self-occupied property.

- Additional dedcution for first-time buyer:

- Section 80EE: An extra deduction of up to Rs. 50,000 is allowed for loans under Rs. 35 lakh on properties under Rs. 50 lakh (applicable for loans sanctioned till March 31st, 2017).

- Section 80EEA: An extra deduction of up to Rs. 1.5 lakh is allowed for Loans on properties with stamp duty values less than Rs. 45 lakh (applicable for loans sanctioned between April 1st, 2019 to March 31st, 2022).

4. Deductions under Section 80C, 80CCC, 80CCD

| Section | Type of Deduction | Proof of Investment |

| 80C | Public Provident Fund | Copy of the stamped deposit receipt paid during the current financial year or Copy of passbook clearly mentioning the PPF account. |

| 80C | ELSS mutual fund | Copy of investment certificate in your name with date of investment, investment amount, type of investment, etc. If you are submitting the proofs in Jan and plan to continue the SIP for FEB and March, you can declare it for those months as well. |

| 80C | Life insurance policy | Premiums paid towards life insurance for self, spouse and/or children |

| 80C | Tax-saving FDs | Copy of the deposit receipt, or passbook |

| 80C | NSC | Copy of NSC Certificate in the name of the employee |

| 80C | Tuition Fees of children | Copy of tuition fees receipt paid to educational institutions along with the nature of payment (donation fees, capitation fees, sports fees, transport fees, uniform and stationery fees, etc. |

| 80C | Post Office Term Deposit | Copy of deposit receipt (qualifying deposits are deposits over 5 years) |

| 80D | Medical Insurance | Copy of premium receipt paid during the year. Copy of the bills of preventive health check-ups in the name of employee or family |

| 80D | Preventive Health check-ups | Copy of premium receipt paid during the year. Copy of the bills of preventive health check-ups in the name of employee or family |

| 80DD | Medical expenses (for handicapped dependent) | Proof of amount spent for medical treatment, training and rehabilitation of handicapped dependent, or, Amount paid towards or deposited in any scheme of LIC, UTI or any other Board approved insurer for maintenance of handicapped dependent. Form 10-1A |

| 80E | Interest paid on higher education loan | Copy of the bank certificate mentioning the principal and the interest amount paid and the amount payable |

| 80U | Physical Disability | Deduction for disability up to Rs. 75,000 (Rs. 125,000 for severe disability) can be availed after providing a medical certificate from any Government Hospital. A copy of certificate in Form 10-1A issued by a competent medical authority stating the percentage of disability should be submitted as proof |

| 80G | Donations | Valid receipts for the donations made that qualify for deduction under this section. Receipts should be in the name of the employee. |

Part III: Verification

Verifying the details that you provided is the final step in Form 12BB. Just sign your name, your parent’s name, the date, the city, and the name.

Conclusion

So, in a nutshell, Form 12BB is your tax-savings ally. Remember to submit it to your employer at the end of the financial year, and you’re on your way to potential tax benefits and a smoother financial journey. Cheers to Form 12BB making your tax matters a breeze!

Frequently Asked Questions (FAQ)

Form 12BB is like your financial superhero cape – it’s needed to ensure you get the tax benefits you deserve. If you’re a salaried employee, sharing this form with your employer is the key to unlocking those tax refunds. It’s a simple way of letting the powers that be know about your claimed benefits. So, why is it needed? To make sure you’re not missing out on any tax perks and to keep your financial world running smoothly!

Form 12BB sample can be downloaded from the Income Tax Department website.

The investments and expenses that you have made or expended to make tax exemption claims via your employer are disclosed on Form 12BB. Form 12BB must typically be submitted in January or February, together with documentation of your investment. Your company will calculate TDS on your pay based on this data.

No, Form 16 is provided by employer after completing the financial year, where as form 12BB is submitted by employee to employer showing the details of investment and expenses made by employee.

You can claim the refund of excess TDS deducted by employer by filing ITR.

2 thoughts on “Form 12BB: Maximize Your Tax Returns Like a Pro!”