The most common misperception concerning QAB balance is that the sum should be retained in a savings bank account during the quarter. Assume an account’s average quarterly balance is Rs.5,000. What people do here is keep an extra Rs.5,000 in their bank account throughout the quarter to avoid penalty charges, as failure to maintain the balance results in wasteful charges on the shortage money.(Banks that provide savings bank accounts include ICICI Bank, Axis Bank, and HDFC Bank.)

However, this is not the case because the calculation of Average Quarterly Balance is done in a different manner that is quite simple to understand. Let’s look at an example of how it was calculated.

Table of Contents

What is QAB Balance?

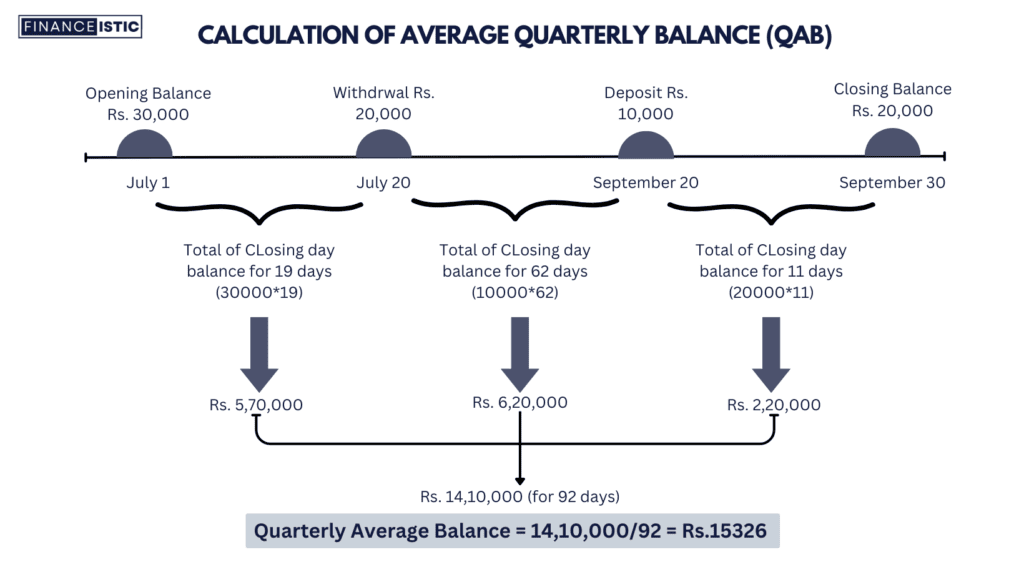

The QAB balance (Quarterly Average balance) is the average of all closing day balances for a given quarter. Simply sum up all of the quarter’s closing day balances and divide by the number of days in the quarter.

As a result, QAB Balance = (Total of all closing day balances in a quarter divided by total number of days in that quarter).

For example, assume you have a savings bank account where you are required to maintain an average quarterly balance of Rs.20,000 from July to September. You withdraw Rs. 20,000 on July 20th and deposit Rs. 10,000 on September 20th. Your average quarterly balance is computed as follows:

You fail to maintain the average quarterly balance of Rs.20,000 as shown in the example above. Keep in mind that for any quarter, the ending balance should not be less than (Rs.20,000 * 92), which in this case is Rs.18,40,000. You might keep the same amount in your account for one day or disperse it throughout the quarter.

RBI Guidelines for Minimum Account Balance

However, on November 20, 2014, the RBI detailed a few changes to the levy of penal fines for failing to maintain the minimum balance/quarterly average balance in a savings account.

According to RBI circular

- As of April 1st, 2015, banks must notify customers via SMS, email, or letter that they will face a penalty if the minimum balance is not restored within a month.

- Penalties should be based on a fixed percentage of the difference between the actual balance and the minimum balance agreed upon when the account was opened.

Important Things to Know About QAB Balance

- Quarterly Average Balance (QAB) varies based on account type, bank type (public or private), and location (urban/metro, semi-urban, or rural).

- Typically, basic savings accounts or no-frills accounts do not have a minimum balance.

- If an account holder fails to maintain the QAB and the balance falls below the prescribed amount, the bank will impose penalty or non-maintenance penalties. Charges may vary per bank.

- Account holders must keep the information about QAB. They can discover it in the information pamphlet or ask the banker directly.

- The QAB, or minimum balance requirements, of public sector banks are often lower than those of private sector banks. The same is true for the penalty for not maintaining the QAB. While banks such as SBI and PNB require roughly Rs.500 as QAB for basic savings accounts, private entities such as HDFC, AXIS Bank, and ICICI want up to Rs.10,000.

- Some banks use average monthly balance instead of QAB. This is the average of the account’s closing day balances throughout a calendar month.

Conclusion

Keeping track of and meeting QAB balance requirements in Indian bank accounts is essential to avoid fees. These guidelines, tailored to different regions, aim to ensure fair and accessible banking services for everyone. Adhering to the specified QAB criteria contributes to a smooth banking experience and financial stability.

Frequently Asked Questions (FAQ)

The QAB balance (Quarterly Average balance) is the average of all closing day balances for a given quarter. Simply sum up all of the quarter’s closing day balances and divide by the number of days in the quarter.

“QAB” stands for “Quarterly Average Balance.” It is a requirement for some savings accounts. If you fail to keep the minimum balance, your bank may charge you a maintenance fee. The QAB costs are determined by the type of savings account you have with PNB as well as the bank’s location or branch.

MAB is similar in idea to QAB. The only distinction is that the QAB balance is computed for three months (i.e. a quarter) at a time, whereas the MAB is computed monthly. To calculate MAB, the bank will sum the day end balances for each day of the month and divide by the number of days in the month.

Bank of Baroda mandates varying minimum Quarterly Average Balance (QAB) requirements based on account holder locations: Rs 500 for rural, Rs 1000 for semi-urban, and Rs 2000 for urban/metro areas. Non-compliance may lead to fees. These guidelines aim to balance banking systems and cater to diverse regional financial needs.

You have Rs 5,000 in your account for the first 85 days of the quarter. On the 86th day, you deposited Rs 100,000 and kept it for the remaining 5 days of the quarter (assuming 90 days). While using the QAB approach, the balance maintained is [(85*5,000)+(5*100,000)]/90 = 925,000/90 = 10,278.